Foreign investors with business activities in Dubai are advised to establish a financial plan for their companies, which will help optimize the expected income returns. Financial planning is a useful tool that can help achieve various goals, set out by following the business plan of the company’s management. Businessmen interested in setting out a financial plan for their business can receive assistance on the matter from our accountants in Dubai.

| Quick Facts | |

|---|---|

| Regulatory environment | Governed by laws and regulations set by the Dubai Department of Economic Development (DED) and other regulatory bodies |

|

Financial statements analysis |

The management, along with our specialists, should study financial statements to assess the company’s current situation and identify areas for improvement. |

|

Taxation |

The corporate taxes in Dubai are as follows: – In Dubai free zones (FZs), businesses have the advantage of a 0% corporate tax rate; – However, the Dubai corporate tax structure imposes a 9% rate on taxable income exceeding AED 375,000; – For taxable income up to AED 375,000, the corporate tax rate remains at 0%. |

| Financial reporting | Compliance with International Financial Reporting Standards (IFRS) is essential for financial transparency and credibility. |

| Currency |

UAE Dirham (AED) is the official currency. |

| Banking |

Access to robust banking services with numerous local and international banks offering tailored solutions for businesses. |

| Investment opportunities |

Dubai provides a wide range of investment opportunities across sectors like: real estate, tourism, technology, and finance. |

| Documents for financial planning |

Key documents for financial planning include: income statements, balance sheets, and cash flow statements, providing insights into revenues, expenses, assets, and liabilities. |

| Financial institutions |

Dubai hosts branches of major global financial institutions, facilitating access to funding, investment, and financial services. |

| Insurance | Adequate insurance coverage is essential to mitigate risks associated with business operations in Dubai. |

| Long-term financial planning |

Involves setting objectives beyond five years, aligning with strategic business goals and market trends to ensure sustainable growth and success. |

| Short-term financial planning |

Focuses on immediate financial goals and objectives for the upcoming year, optimizing resources and strategies to achieve short-term profitability. |

| Legal compliance |

Adhere to all legal requirements regarding employment, contracts, intellectual property, and other business operations. Our advisors can help you in this regard. |

| Currency exchange |

Monitor currency exchange rates and fluctuations to mitigate foreign exchange risks and optimize financial transactions. |

| Financial advisors | Consider seeking guidance from our financial advisors with expertise in Dubai market to optimize financial planning and decision-making. |

Table of Contents

How financial planning should be observed in your company

Our team of accountants in Dubai can help local and foreign businessmen to establish a financial plan set out to achieve various business goals related to sales, prices, production, investments, the manner in which the company will pay its debts (if it is the case) and other aspects. To establish a financial plan, the investor should set out several objectives on a short-term (one year), middle-term (5 years) and long-term (a period longer than five years), taking into account the business opportunities offered by the Dubai market. Business planning should provide answers to the following situations:

- an analysis of the current situation of the company;

- establishing certain financial goals;

- keeping a track on how a company’s goals are completed.

To proceed to these actions, the management of the company, alongside specialists in the field, should study the financial statements, which will provide a clear image of the current situation of the business and aspects that should be improved. Please bear in mind that our Dubai accountants are at your disposal with assistance and information about how you can set up a financial plan. Likewise, audits in Dubai performed by our auditing firm in Dubai should be considered once you have your operations on the market.

How to plan the expenses in the company

Determining the budget for your activities represents the initial step in financial planning in the long or short-term. It is advisable to know all the aspects of the business you wish to implement on the market and to be confident that your services or products will have success. The established budget will show how the business works and will help the entrepreneur set up the goals. In this stage, one must determine the number of sales that will lead to profit, the necessary expenses to sustain the sales, and whether there will be additional costs in certain situations or not. A clear analysis of the balance sheet in each step should be performed as soon as you enter the market and gain the first profits.

Do you need an audit company in Dubai? We recommend the services of our specialists in the field if you own a company in the UAE. there are a number of legal procedures, with the help of which, accounting experts can prepare complete financial reports. They serve to reveal the financial situation of the company, and where appropriate, certain measures can be implemented. With our help, you will ensure the smooth running of the company, from a financial point of view.

Useful documents for establishing a financial plan in Dubai

The financial plan should be established based on the following three documents:

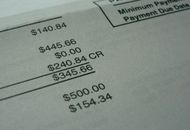

- income statement – the document provides details on the company’s revenues and level of expenses;

- balance sheet – the main information offered by the document refers to assets (cash, inventory, equipment) and the liabilities (loans and debts) of the company;

- cash flow statement – shows the amount of money expected to be received or paid by the company.

The difference between personal and business goals

Any kind of entrepreneur has personal targets besides the business goals, so it is quite important to calibrate the balance before the company is active. It is true that the personal goals might not be that realistic, however, these can be sustained by the business objects and aspirations, and vice versa. Below you can find interesting and helpful advice to consider at the time a business and financial planning are created:

- Small, medium, and large companies need complete proficiency when it comes to determining the financial planning in business, and research and data gathering skills have their share of significance.

- The quality of information will pretty much highlight the accuracy of the financial plan of the business.

- It is recommended to make a financial business plan each year which needs to include the profit and loss statements.

- Financial changes or discrepancies can be discovered if the financial results are compared to the ones found in the forecast.

The financial results might be hard to predict, especially considering that the final client’s behavior is not the same on a daily basis. Complete support for financial planning for your business in Dubai can be offered by our team of accountants in Dubai at any time.

A positive cash flow – What it is important to know

A positive cash flow is something any company should pay attention to, right from the time the business is planned. The present and future financial expenses need to the scheduled in time in order to avoid any cash-flow problems, and this issue is highly recommended by experts in the field, including by our team of accountants in Dubai.

What are the features of business financial planning?

Whether you have a short or a long-term business plan, the financial forecasting must comprise the P&L (profit and loss) statement which will show if the company has profits or losses in a specific period of time. Such a document also contains a series of costs of the products sold or bought. The sales forecast is also a very important part of the financial planning and it is a report that includes information about future projects, sales, and costs, mentioning that these predictions can be done for one or more years. The sales forecast is the type of report met in most of the businesses established in Dubai and it represents a way to determine in a large percent the financial health and status of the company. The break-even analysis is another significant feature and tool of a business financial planning that shows how much profits a company needs to register, considering the expenses for the products sold. This way you can verify if the company is profitable or not and if there are risks of losing money in the firm instead of generating more incomes. Tax planning strategies are mandatory for any type of business in Dubai and varied financial tools can be recommended by an experienced team of accountants.

Can I get financial planning assistance in Dubai?

Yes, you can get in touch with one of our consultants in Dubai and solicit complete financial planning assistance, as our team has ample experience in this field. This kind of support will help a company have an accurate start from a financial point of view, alongside the confidence that you will be helped in a professional manner at the beginning of the road in terms of business. Looking for the contribution of an experienced team of advisors is always a good idea, especially if you are a foreign investor in the UAE and you do not have a complete and clear picture of the business strategies in this country.

10 financial tips for small companies in Dubai

The business climate in Dubai is found on a positive trend, plus, it remains extremely appealing to international entrepreneurs at the beginning of the road. Here are 10 important financial tips for small companies in Dubai that might attract your attention:

- Create a plan and work on your business right from the start. It is best to have a plan before company formation and registration. A specialist will then analyze the plan and bring other modifications too.

- Establishing the business objectives is important in this stage. Future business owners must draw a distinct line between the personal and the business goals. If an entrepreneur is interested in saving as a personal goal, when it comes to business, growth and development enter the discussion.

- Looking for investments is another significant aspect to consider for financial planning in Dubai. Business loans, invoice finance, startup finance, personal savings, and private equity funding are great options to consider.

- Controlling the costs should be in the attention of small business owners in Dubai at the time financial planning is created. One must have a clear picture of the revenues and the costs of the firm. Growth opportunities will play a great role.

- The cash flow needs to be supervised. The accounts payable can be overseen by one of our accountants in Dubai who have experience in this field. Let one of our specialists tell you more details on this matter.

- Tax liability is part of the financial planning for business in Dubai. It is important to understand the tax liabilities for the newly-established company in Dubai. One of our specialists can help from the start.

- Attach a financial safety net when creating a financial plan for your business in Dubai. If a specific percentage of your personal savings is found in the company, one must consider protection measures. A potential financial conflict can be avoided if personal assets are transferred.

- Create a marketing plan from the beginning and make sure you adopt the most useful tools. You want your business to grow on a yearly basis, so feel free to consider this important aspect.

- Hire a team of specialized accountants to oversee your financial planning for your business in Dubai. Foreign entrepreneurs must comply with the applicable regulations.

- Be aware of the profits and losses in the firm. It is best to know in time the vulnerable areas in the company and avoid any probable issues that might affect the business growth.

These are in large lines some useful tips for persons interested in financial planning in Dubai. The support of our accountants in Dubai is at your disposal right from the start, so feel free to discuss all the details with our team.

Hiring the services of an experienced financial advisor in Dubai

A business in Dubai needs the support of a financial expert to offer from the start the optimal solutions for the good development of activities. In addition to a well-prepared financial plan, it is important to supervise financial operations in a company, to ensure that there are no problems from this point of view. Here’s how a financial advisor in Dubai can help you and what features you should consider when choosing your services:

- The planning of financial strategies comes to the attention of a tax advisor who knows how to propose the optimal solutions for a company, regardless of its activities.

- Experience in the financial field is important, therefore, the services of a senior tax advisor are recommended.

- Legislation in the financial field can change at any time, therefore, a financial consultant must know all the changes in this area, in order to provide the right advice and optimal solutions for the company.

- Financial risks exist everywhere, especially in the business climate. An experienced tax advisor knows what financial strategies to offer to business owners in order to avoid potential monetary risks that may interfere with the smooth running of the business.

How an accountant in Dubai can help you

The services of an experienced accountant are recommended for any business in Dubai. There are a number of issues that an expert in this field can successfully cover. Our team of accountants in Dubai offers management accounting, complete bookkeeping services, tax consultancy, tax planning, complete financial planning for small, medium, and large companies, business advice, audits in Dubai, tax minimization methods, and many other services tailored to every business needs.

What differentiates active accountants available on the market is the experience. This plays an important role, therefore, people interested in the services of such an expert are advised to make certain checks before choosing the specialist. We invite you to talk to our team of accountants in Dubai and discover the benefits of our services. We are here to offer the necessary support to both local and international investors for financial planning in Dubai.

Hiring the services of an audit firm in Dubai

The financial status of a firm in Dubai can be revealed by an audit report created in respect to the International Financial Reporting Standards, in the first place. An auditor with experience can be hired for your company in Dubai. He or she can perform specific audits, in complete objectivity and transparency, and present a report in this sense.

One should note that an audit report reveals the financial aspects of a firm, if any possible financial issues can be fixed, and if particular financial strategies can be presented and implemented in the firm. Talk to one of our specialists and see what type of audits you need for your firm in Dubai. You can also ask for financial planning in Dubai and see what are the best options for your business.

Understanding the tax system before starting a business

When deciding on a business in Dubai, it is important to consider a fair and complete financial plan in order to understand the applicable tax system. It is known that the UAE offers an extremely beneficial tax regime, even if the VAT was recently implemented in this country.

An optimal financial plan for the business at the beginning of the road is therefore necessary and can be made by an expert in the field. He or she will know from the beginning what kind of investments and what types of costs are involved in a business, depending on activities and goals. We invite you to talk to one of our experts and find out all the details about creating a financial plan for the business you want to open in Dubai. Specialized help is offered to foreign investors who want to benefit from support and advice.

Why work with our specialists in Dubai

Our experience in the financial consulting field is recommended for businesses of any type in Dubai. Our clients can rely on professionalism, transparency, and trust when collaborating with us and can benefit from quality services, tailored to their business needs.

Whether you are a local or foreign investor, it is important to make the best decisions for the business you own or to be registered in Dubai. Discover our services and find out how we can help you achieve a successful financial planning.

FAQ about financial planning for a business in Dubai

1. What is financial planning for a business in Dubai?

A financial planning refers to a series of targets on long or short-term to help an entrepreneur understand the business direction. The company’s goals are overseen with the help of a financial business plan.

2. Can a financial plan highlight the situation of the firm?

Yes, a complete and accurate analysis of the company’s current status is highlighted by a financial business plan.

3. Who can make a financial planning in Dubai?

Accounting specialists, company managers, and business experts can be hired for the creation of correct financial planning for a business in Dubai. You can discuss with our team of accountants in Dubai and find out more details in this matter.

4. Can I plan the expenses in the company?

Yes, with the help of financial planning in Dubai, the budget is established. Plus, the number of sales and the profits will be accurately highlighted with the support of a financial plan.

5. What type of documents do I need for a financial planning?

The cash flow statement, the balance sheet, and the income statement are required for creating a correct and transparent financial plan for a business in Dubai. You are invited to talk to our team of specialists in Dubai for comprehensive assistance and support.

Small, medium and large companies require precise financial planning, in order to determine the business goals, the profits, and the overall direction of the operations. You can benefit from a financial planning in Dubai with the help of our team of accountants. All you have to do is to send your inquiries and let us help you right away. Young entrepreneurs from overseas should solicit our support before opening a company in Dubai.

Below you can discover a few important facts and figures about the investment direction in UAE, in order to ease the path of entrepreneurs deciding on business in this important financial destination:

- according to statistics, the total FDI stock UAE in 2019 stood at approximately USD 154 billion;

- approximately USD 13,5 billion was the total value of the greenfield investments in UAE in 2019;

- UAE is ranked 16th out of 190 worldwide economies, as stated by the 2020 Doing Business report;

- most of the FDI flows in UAE are directed to sectors like finance, insurance, real estate, and trading.

Soliciting support in matters of accountants, tax planning and related aspects can help international investors thrive in the competitive and appealing market in Dubai. If you need further information on financial planning in Dubai, please contact our accounting firm in Dubai for assistance.